What are investment platforms?

Investment platforms offer investors the possibility to invest in financial instruments – debt securities based on loans granted by credit issuers. The model implemented up to now, in which the offering of investment was based on the entering into a cession agreement, has been replaced entirely by the model of offering financial instruments, thus providing investors with the statutory protection.

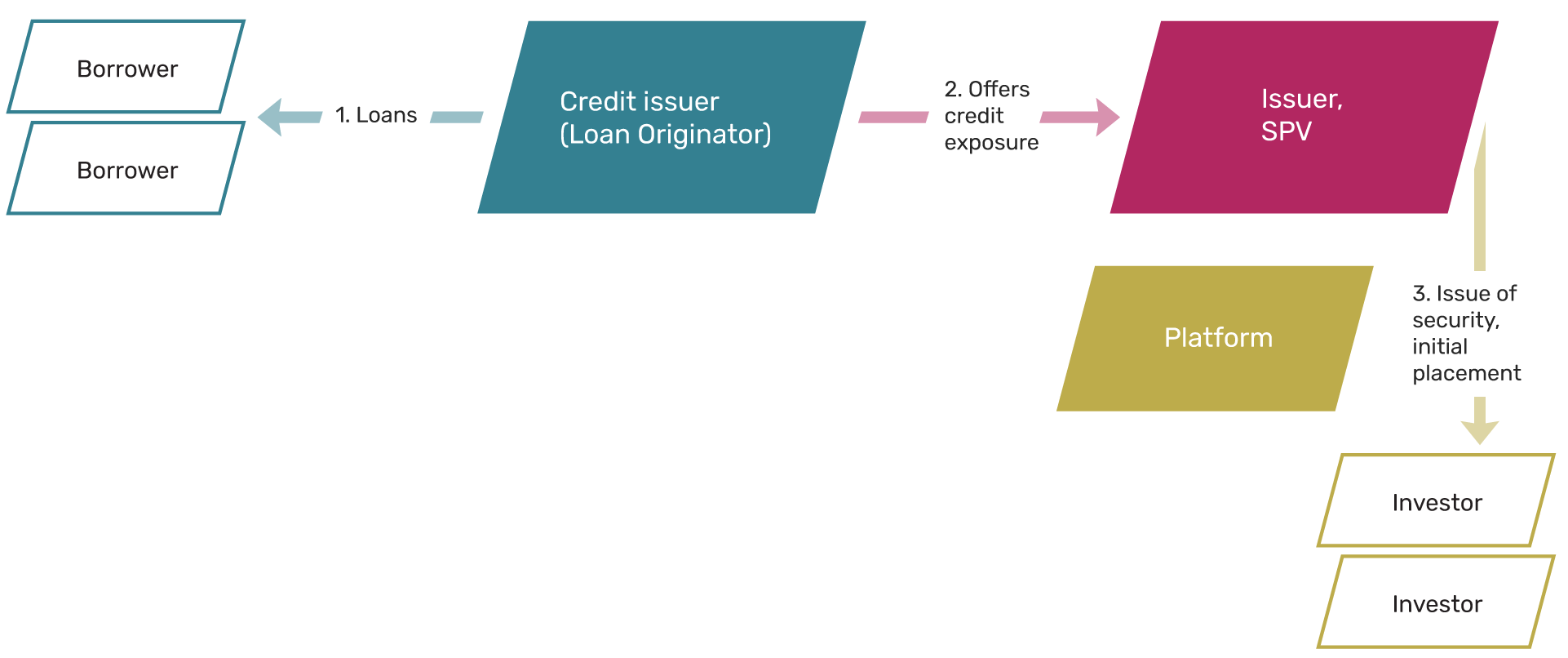

The investment platform business model

Credit issuers sell rights of action arising from their loans to a special purpose company or Special Purpose Vehicle (SPV). Only activity of SPV is the purchase of rights of action and the issuance of asset-based debt securities. A SPV, the issuer of the debt securities, distributes these debt securities or financial instruments to investors through investment platforms. For the provision of such services, an investment platform is required to obtain an investment firm operating licence in accordance with the Law on Investment Firms. Upon obtaining an investment firm operating licence, investment platforms may offer investors a wide variety of financial instruments.

Latvijas Banka issues licences and supervises the functioning of this segment, thereby supporting and monitoring the functioning of understandable and transparent investment platforms.

Regulation

For investment platform, in order to provide services, it is necessary to obtain a credit institution or investment firm operating licence.

The investment firm is obliged to comply with the requirements of the Law on Investment Firms and other regulatory requirements related to the financial instruments.

- Section 3 of the Law on Investment Firms. Application of this Law.

- Section 3 of the Financial Instrument Market Law. Application of this Law.

- Section 6 of the Law on Investment Firms. Initial Capital of Investment Firm.

- Section 10 of the Law on Investment Firms. Documents to be Submitted for Receiving the Licence.

- Chapter II of the Law on Investment Firms. Licensing of Investment Firms.

- Chapter VI of the Law on Investment Firms. Provision of Investment Services.

Important note! Depending on investment and ancillary services provided, investment platforms have to comply with certain requirements of the Law on Investment Firms, the Financial Instrument Market Law, the Law on the Prevention of Money Laundering and Terrorism and Proliferation Financing, the Securitisation Regulation and the Prospectus Regulation.

Obtaining a licence

The meeting of a market participant with Latvijas Banka during which the market participant presents information on the platform business model and Latvijas Banka assesses the possibility of granting a licence.

The market participant prepares and submits the necessary documents for examination to Latvijas Banka.

Latvijas Banka assesses the application and the market participant makes adjustments, if necessary. Time limit for examining the application – six months.

The market participant receives a licence and instructions regarding further cooperation with Latvijas Banka.

Learn more about obtaining a licence

Investor protection

When carrying out transactions in financial instruments, investor protection should be ensured in line with the Financial Instrument Market Law, Investor Protection Law, Directive on Markets in Financial Instruments (MiFID II) and Packaged Retail and Insurance-based Investment Products Regulation (PRIIP), as well as other regulatory requirements related to the financial instruments area.

Investors should provide information on investment risks and investment costs, ensure the suitability and compliance assessment of customers' knowledge and investment experience in relation to specific products, as well as keep investor funds separate from the enterprise's own funds. Also, requirements aimed at raising awareness of investors and protection of investor interests should be met.

In the event an investment firm licensed by Latvijas Banka becomes insolvent and is unable to meet its obligations, each investor is entitled to compensation of up to EUR 20 000 in the amount of outstanding liabilities.

Consultations with experts of Latvijas Banka

"*" indicates required fields