Faster, more convenient and efficient: innovations used by Latvian financial market participants

This blog explores the innovations currently used by Latvian financial market participants. The data have been obtained by surveying Latvian financial and capital market participants.

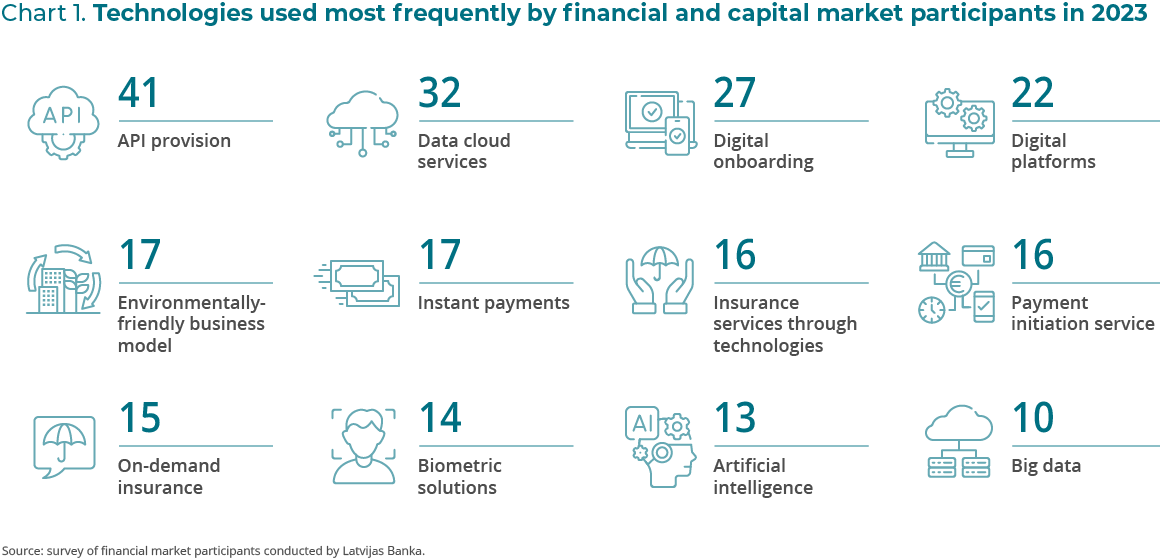

The application programming interface (API), data cloud services and digital onboarding are the three technologies used most frequently by market participants.

For the third consecutive year, credit institutions, insurance brokers and insurance corporations have been the market segments using innovations in their operation most frequently. Meanwhile, none of the surveyed businesses in two financial sectors – cooperative credit unions and registered alternative investment fund managers – use innovations.

New business models, innovative processes and products

All innovations included in the survey were divided into four groups: new business models (Group 1), new and innovative processes (Group 2), new and innovative technological applications (Group 3) and new and innovative products (Group 4).

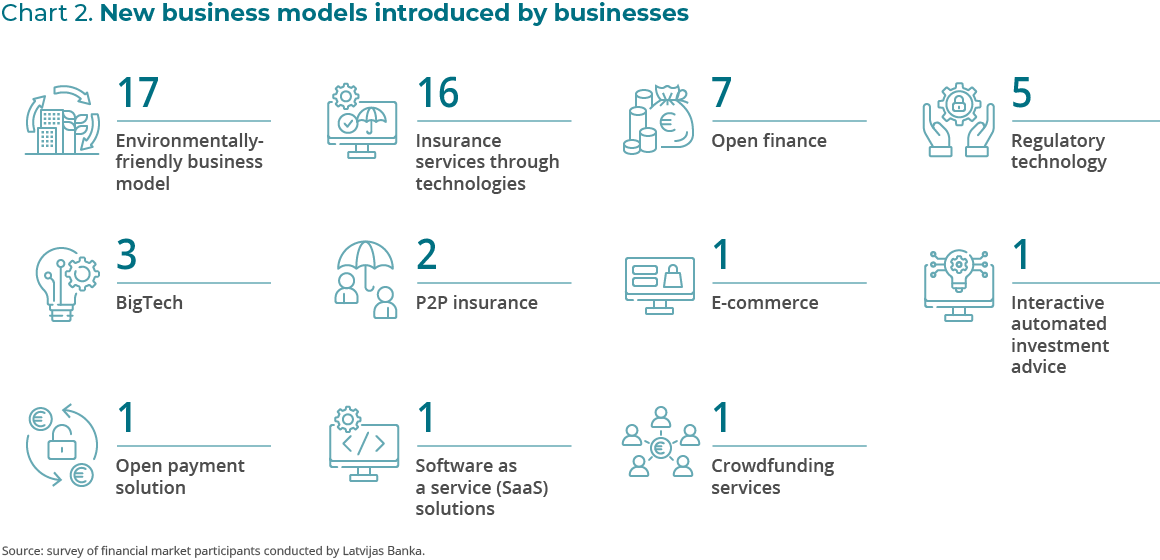

The innovative technologies used most frequently by financial market participants in Group 1 "New business models" are an environmentally-friendly business model, insurance technologies and an open finance business model as well as regulatory technology (RegTech). Insurers and insurance brokers choose environmentally-friendly business models and the provision of insurance services through technologies. Credit institutions have integrated environmentally-friendly business models into their operation; most of them have also integrated an open finance business model. An open finance business model expands the concept of open banking – it is a possibility to transfer data to third parties; furthermore, it can be done not only by banks, but also by insurers, pension funds, etc.

Out of new business models, BigTech and P2P insurance are used in fewer cases.

This year, crowdfunding services also appear among new business models for the first time – the first authorisation to provide crowdfunding services in Latvia was issued last year.

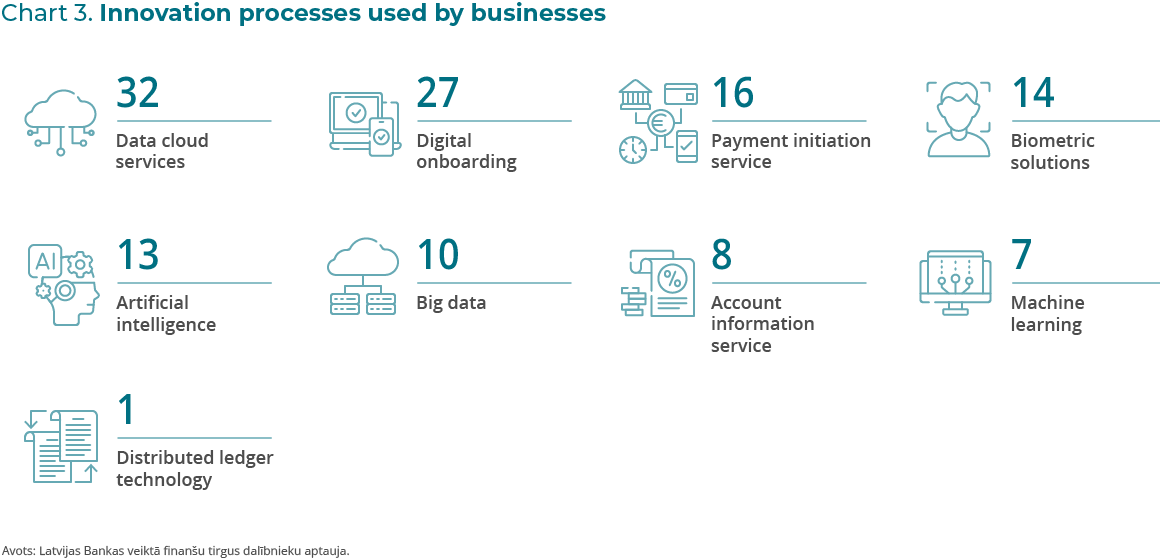

The analysis of the innovative technologies used from Group 2 shows that the new and innovative processes used most often are data cloud services, digital onboarding, payment initiation service, biometric solutions and artificial intelligence. Innovative processes such as big data, machine learning and account information service are used less frequently. An innovation previously not used by Latvian market participants – the distributed ledger technology (DLT) – has appeared for the first time this year. This innovative process is employed by one of the survey participants.

It has been found in the analysis of the innovative technologies used from Group 3 that all segments participating in the survey and using innovations in their operation also use the API provision. The second most popular application among the survey participants is the digital platforms followed by instant payments. Only one business indicated the usage of smart contracts in the survey.

Meanwhile, the most frequently used innovation in Group 4 "New and innovative products" is on-demand insurance. Out of the survey participants, insurance brokers and insurance corporations are the most active providers of innovative products. This suggests that these businesses have a positive attitude and are ready to offer flexible insurance solutions corresponding to the individual needs of customers. The participants of several other market segments have ample growth opportunities for introducing innovative products – currently, innovative products are not used by the surveyed cooperative credit unions, investment management companies, foreign exchange companies, payment institutions and alternative investment fund managers.

Usage of artificial intelligence is increasing

Compared to 2022, the most notable rise in the use of any innovation is observed in the usage of artificial intelligence and instant payments. Currently, artificial intelligence is already employed by several insurers, credit institutions and investment firms as well as some market participants representing the financial market segments such as insurance brokers, payment institutions, private pension funds and crowdfunding service providers.

Trends suggest that artificial intelligence, big data and machine learning drive the development of innovation technologies and are able to introduce changes in the market and the provided services. Artificial intelligence solutions not only ensure the best methods for data processing and enhancing customer experience, but also simplify, accelerate and newly define the traditional processes by making them more efficient. Globally, machine learning is already used for the projection of revenue and stock prices, the supervision of risks and the management of things.

In its turn, the usage of big data provides businesses with substantial competitive advantages, namely, a possibility of offering more personalised services. Businesses can have a 360-degree view of the interaction between customers and the brand, including basic personal data, transaction history and interaction in social media, to ensure a more complete information package on their customer.

Challenges

As the usage of innovations in businesses becomes more widespread, the related risks also emerge, potentially affecting both financial businesses themselves and their customers. Therefore, the introduction of innovations goes hand in hand with risk awareness and management. Businesses should be conscious of risks to data security, cybersecurity, compliance as well as safety and know how to manage them.

The introduction of innovative solutions involves a range of challenges. The lack of finance, the shortage of labour force and an insufficient development of information systems were indicated most often by the surveyed businesses as obstacles to innovation development.

Advice by experts of Latvijas Banka

Financial market businesses should also understand the regulatory and supervisory requirements. In this regard, significant support is provided by Latvijas Banka – at the Innovation Hub, experts of Latvijas Banka provide advice on the compliance of innovative financial products, services or business models with the licensing requirements and regulatory acts and give answers to questions about supervision, also including in the field of information technology security, etc.

Conclusion

This survey demonstrates the ability of Latvian financial and capital market participants to accept innovative technologies that provide advantages. The results of the previous years and this year's survey suggest that Latvian market participants continue actively adjusting and applying innovations to enhance customer experience and provide modern and efficient services. Such commitment to be the driver of the innovation technology development shows that we are on the right track leading to the development of a sustainable and competitive financial sector in Latvia.

On the survey

In the spring of 2023, for the fourth consecutive year, Latvijas Banka conducted the survey on the innovative financial technologies used by Latvian financial and capital market participants. 211 market participants were invited to take part in the survey with 154 market participants eventually completing the survey. 55 of them indicated that they were currently using an innovative solution in the provision of financial services, while 34 were planning to start using innovative technologies in the future. 24 businesses had created a team for the development and introduction of innovative solutions. All survey results and the related conclusions are based on the data provided by market participants.

This year marked the first-time participation of foreign exchange companies, registered alternative investment fund managers and a crowdfunding service provider in the survey.

The survey is based on the first innovation map presented in the working group of the European Forum for Innovation Facilitators and created by the European Securities and Markets Authority in cooperation with the European Banking Authority, the European Insurance and Occupational Pensions Authority and the members of the group of the European Forum for Innovation Facilitators.