Compared to the previous year, there are changes in the top of the most used technologies, namely, in 2020, the most frequently used FinTech solutions were: strong customer authentication (18 market participants), provisioning API (11), biometric solutions (11) and big data (9).

Over the year, there has been a significant increase in the use of the following FinTech solutions: provisioning API, biometric solutions, contactless payments and cloud computing services.

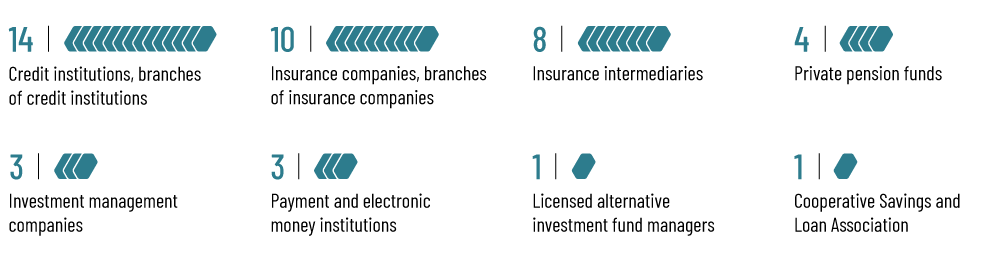

The analysis of the innovative technologies used by market segments shows that the major user of innovative technologies is a credit institution segment – the most popular solution in this segment is provisioning API that credit institutions mainly use for open banking with FinTech companies. It is followed by the insurance sector, representatives of which most frequently used following innovative technologies: provisioning API, cloud computing services, biometric solutions, contactless payments and big data. Cooperative savings and loan associations and licensed alternative investment fund managers make little use of financial technologies. Investment firms, however, do not use FinTech solutions at all.

A dedicated team for the development and implementation of innovative solutions has been set up by 15 market participants, namely seven credit institutions, two insurance companies, as well as one representative of the following market participants: payment institution, electronic money institution, private pension fund, insurance broker, investment management company and investment firm.

A survey conducted by the FCMC shows that there are two innovation strands in Latvia’s financial and capital markets: one arises from market regulation (Second Payment Services Directive, near-field communication (NFC), provisioning API, while the other is based on the own initiative of financial and capital market participants (biometric data, artificial intelligence, big data, robo-advisor, machine learning, etc.).

The survey results indicate that over the next two years market participants are planning to develop and implement FinTech solutions for these two innovation strands, with a particular focus on provisioning API, biometric solutions, big data, artificial intelligence and machine learning.

As obstacles to the implementation or successful operation of the FinTech solution, market participants identified regulatory barriers, such as compliance with laws and regulations, legislative restrictions, complicated regulatory requirements, a lack of experienced IT specialists in the market, as well as financial barriers such as limited financial resources and a lack of investment.

Published:03.08.2021