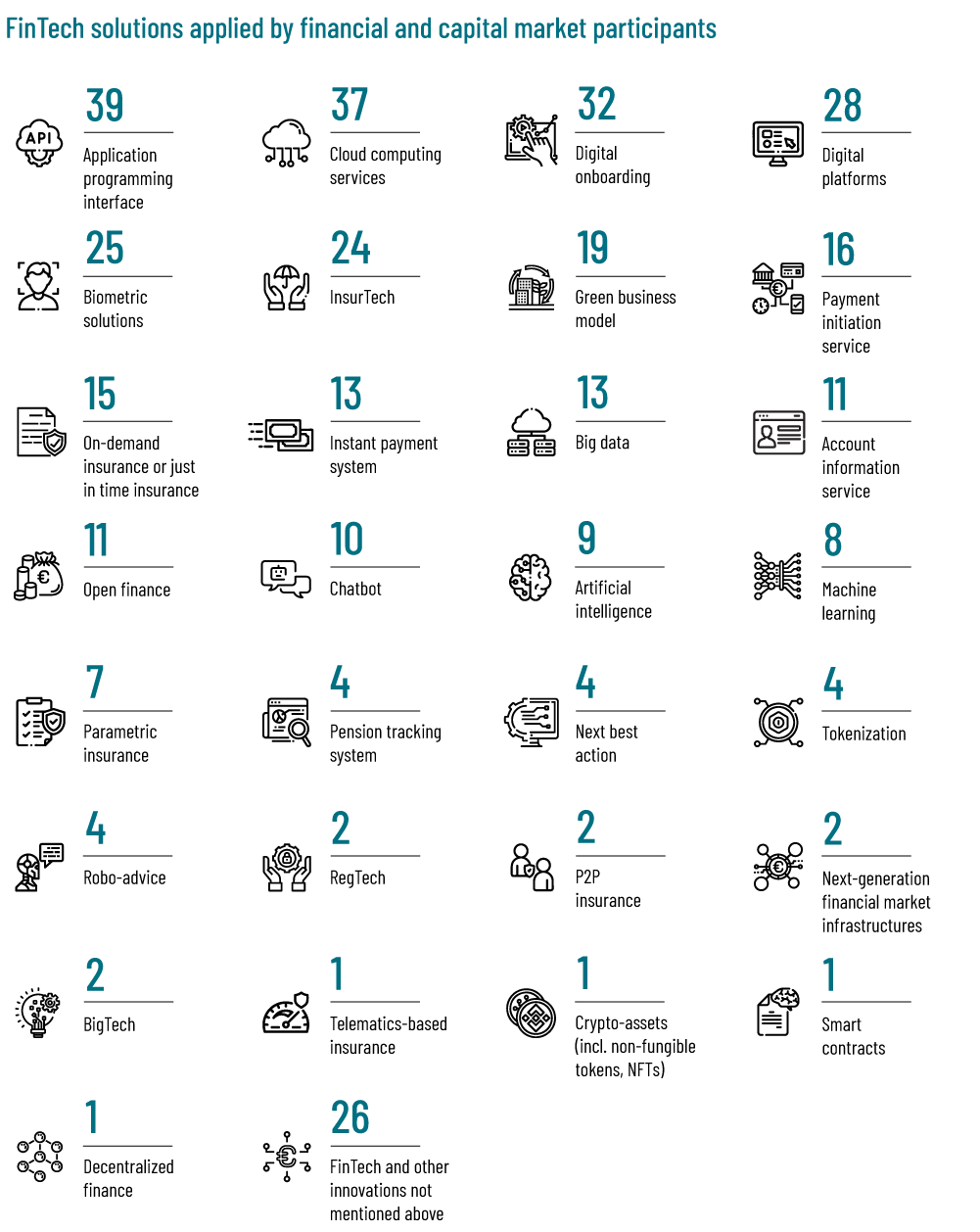

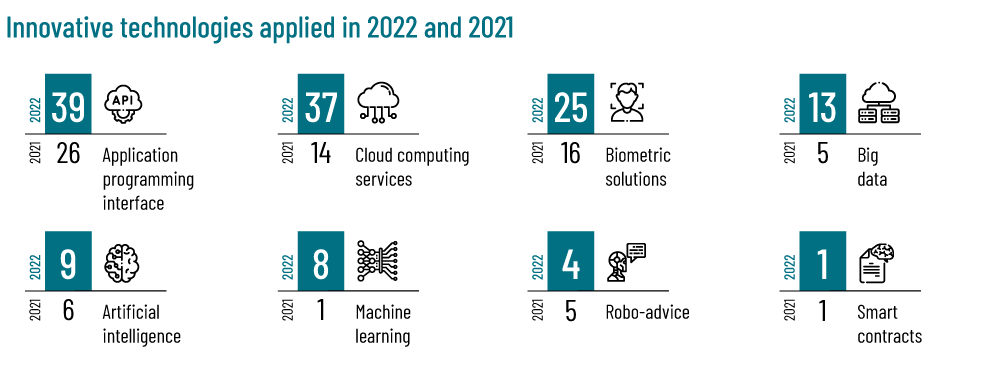

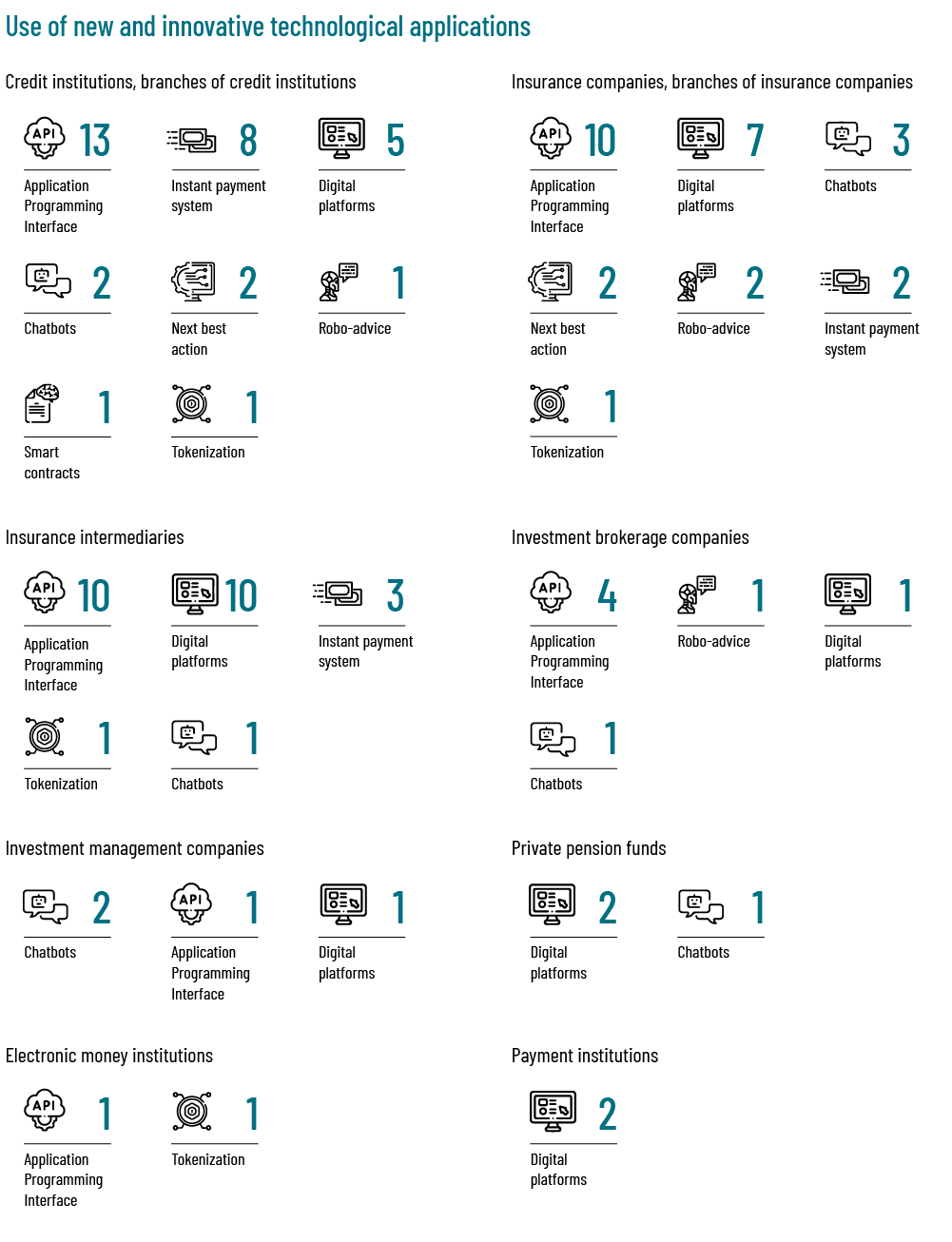

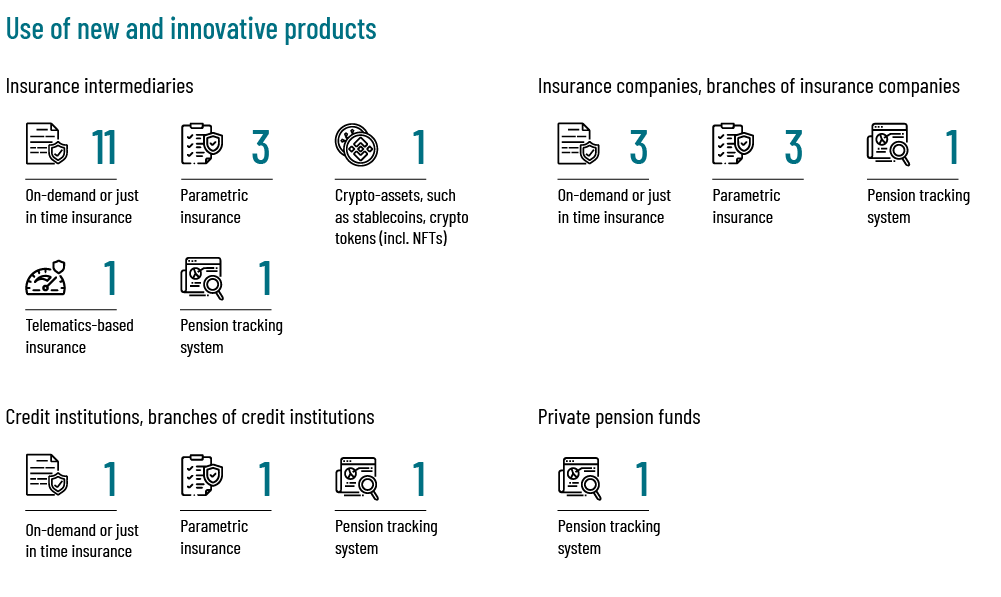

The results of the survey indicate that percentage of market participants planning to develop and implement new and innovative processes and innovative technological application innovation group Fintech solutions in coming years has increased by 143% over the year, with a particular focus on the solutions already in use: API, cloud computing services, artificial intelligence, machine learning, biometric data, automated advice, digital customer acquisition and digital platforms, as well as the solutions not yet used, namely crypto-assets.

The commitment of financial market participants to develop innovations is also demonstrated by human resources dedicated for that purpose, namely 34 market participants have set up a dedicated team for the development and implementation of innovative solutions with an 87% increase in their number since 2021.

Among the barriers to the introduction or successful operation of FinTech solutions, market participants indicated the regulatory framework, such as compliance with laws and regulations, legislative restrictions, complexity of legal requirements, as well as the lack of experienced IT specialists on the market and financial barriers (limited financial resources, lack of investments). The above barriers were also indicated by market participants also in the 2021 survey. The following were indicated as new barriers to the introduction of innovations this year: complicated move from historical to new solutions, customer ability to adapt and unclear cryptocurrencies regulatory framework.

Published:07.06.2022